Reimagining Banking Processes to improve User Experience

Reimagining Banking Processes to improve User Experience

Reimagining Banking Processes to improve User Experience

Project summary

Project summary

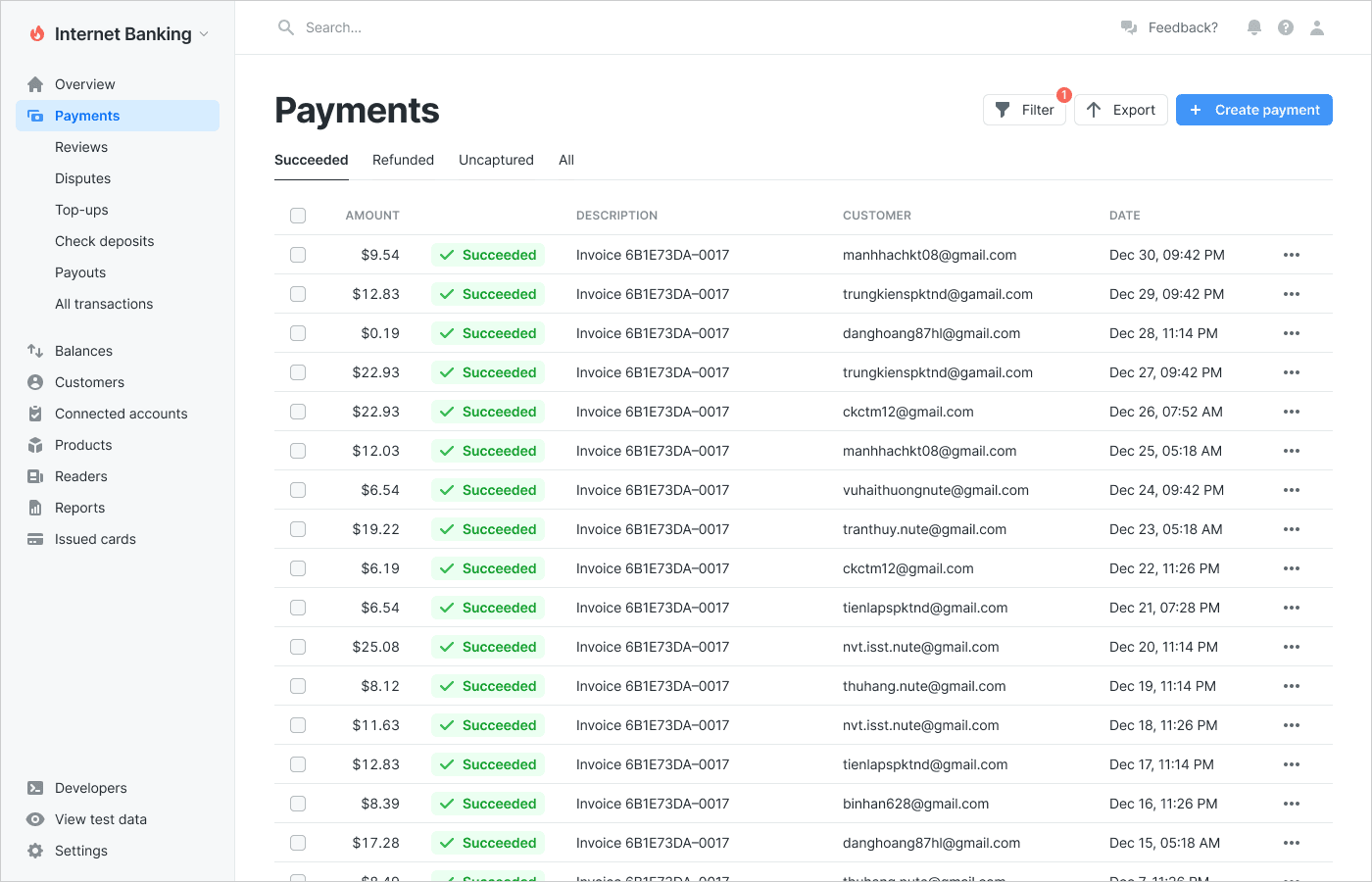

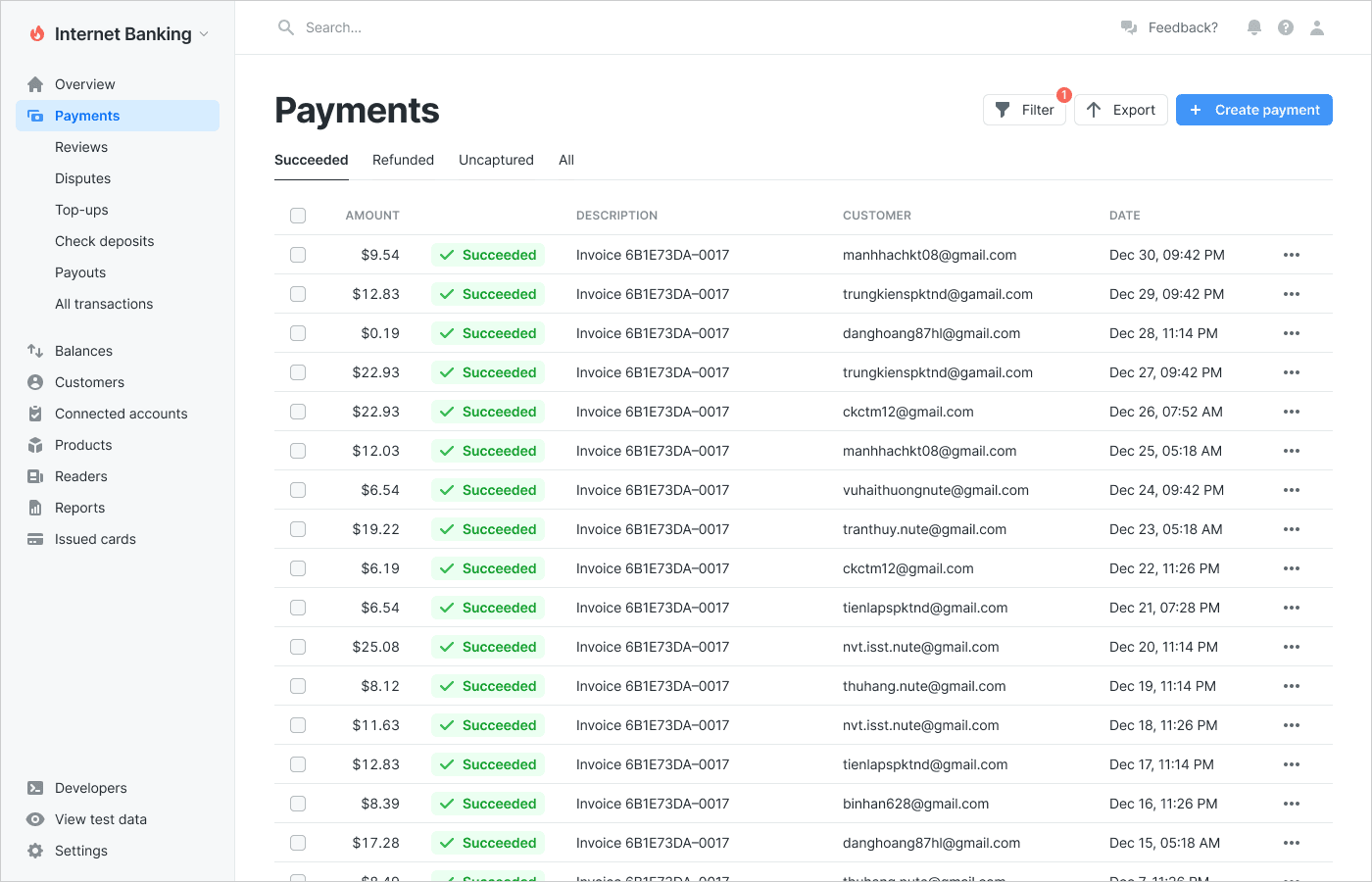

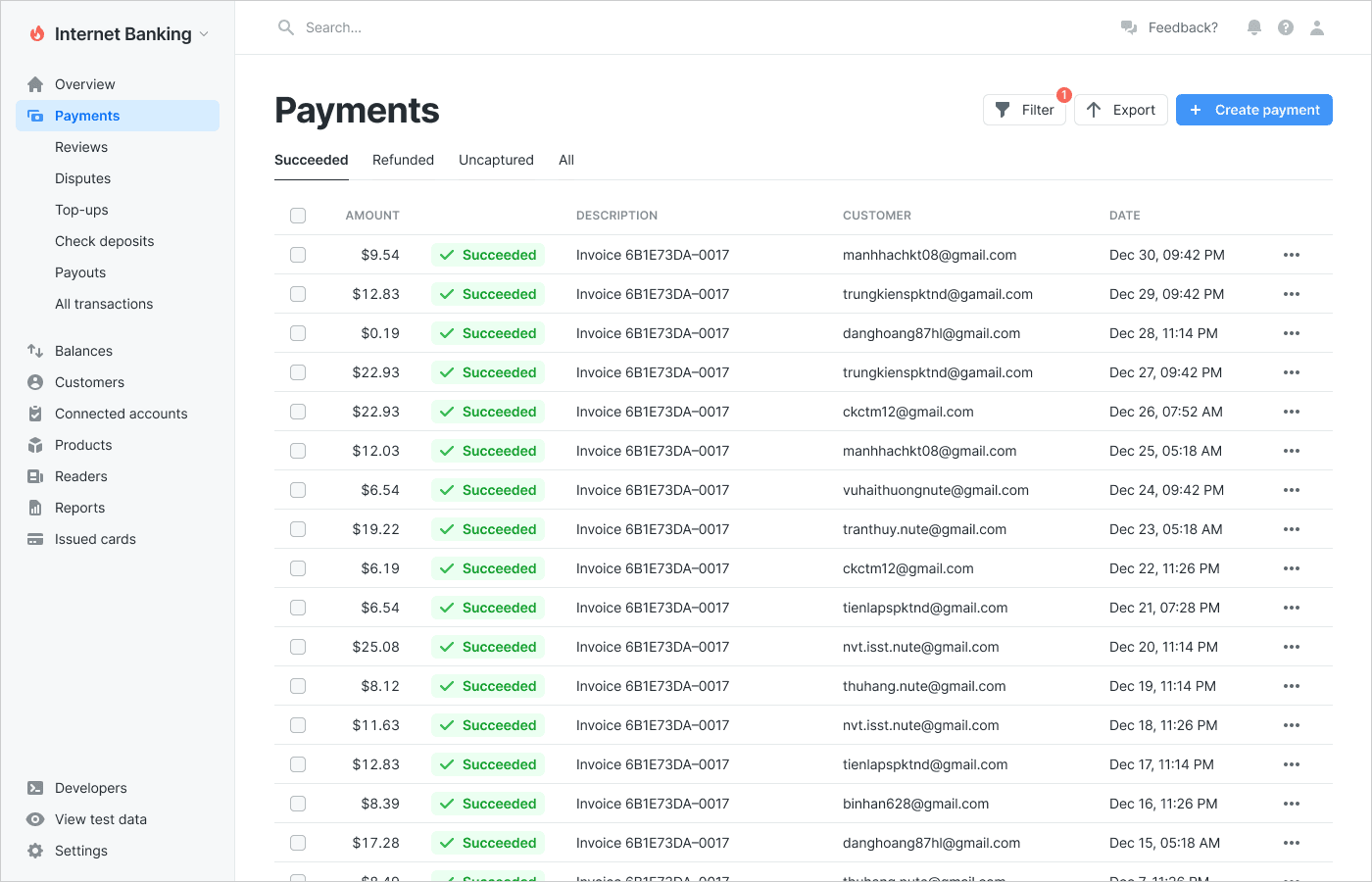

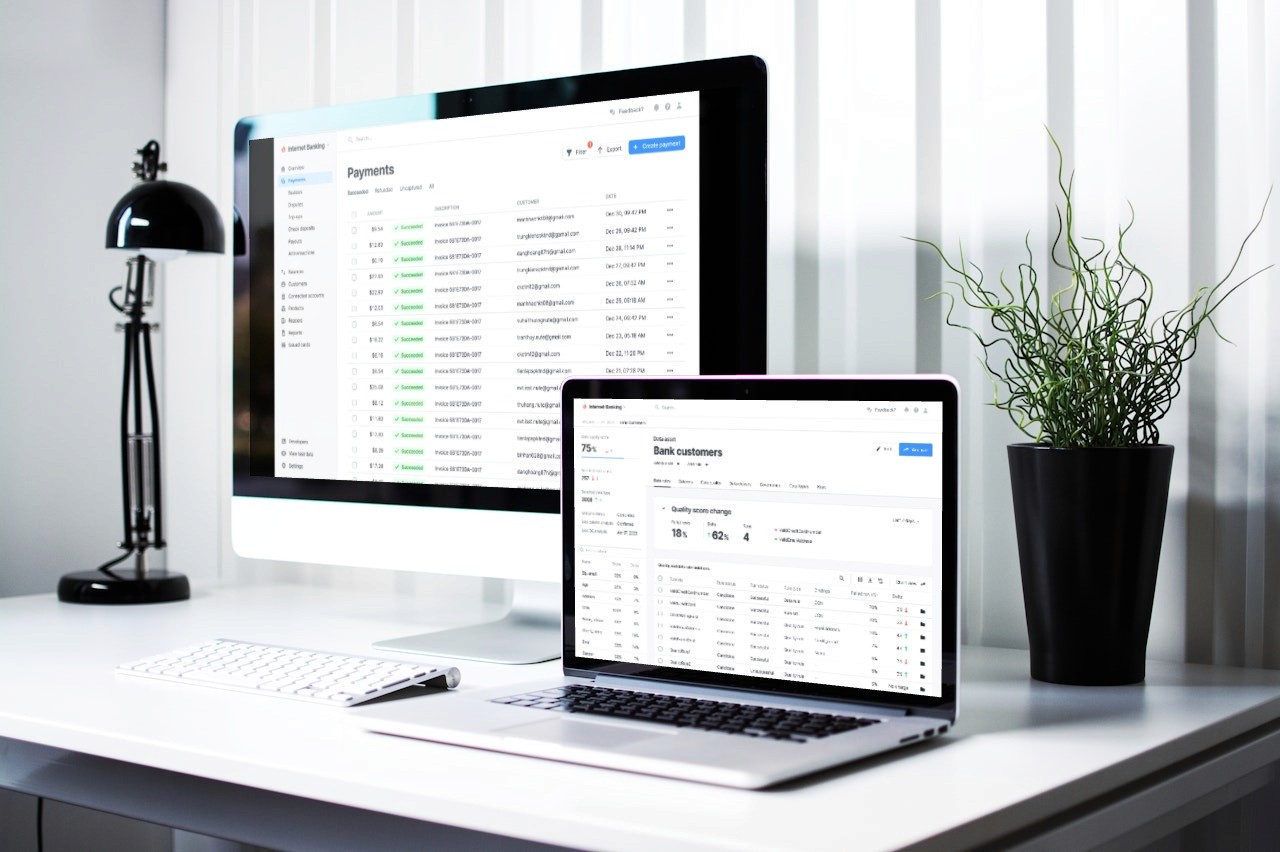

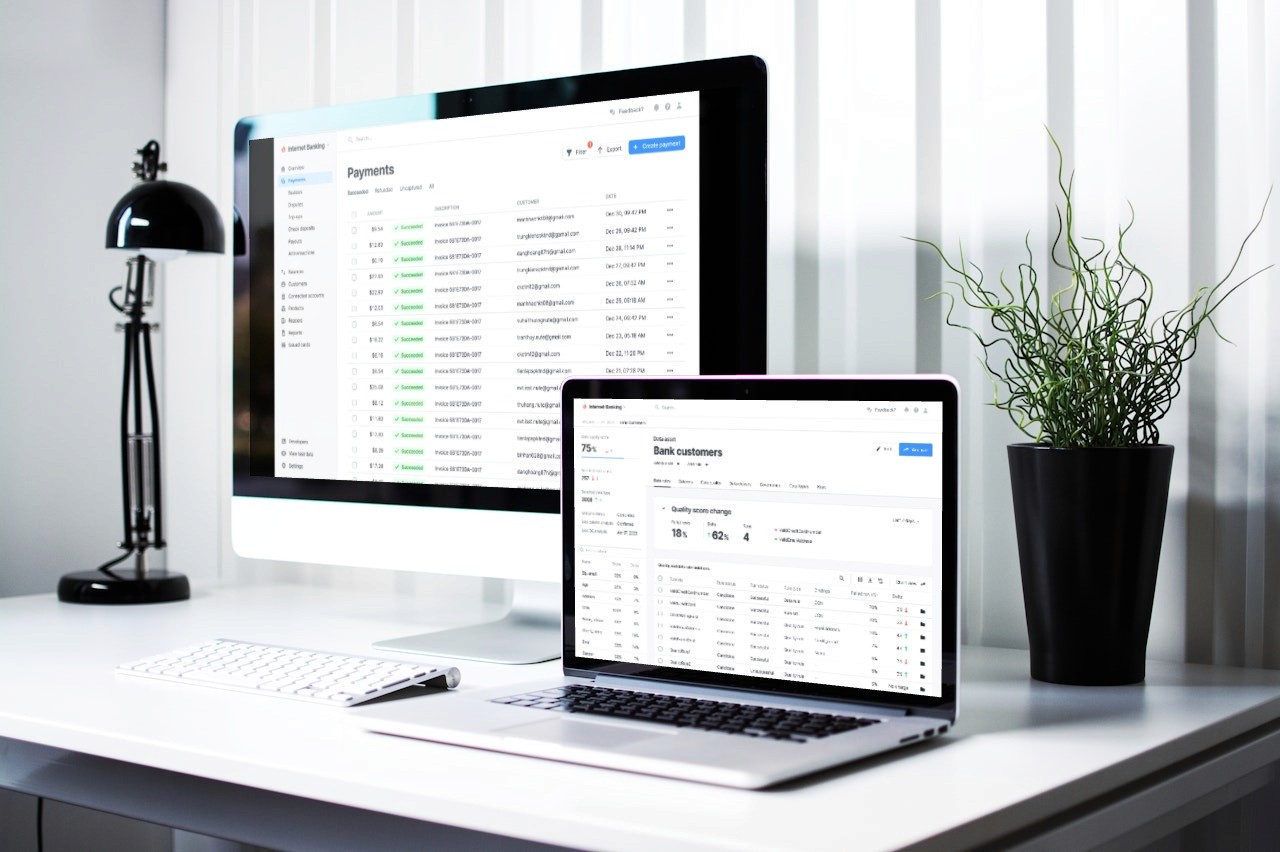

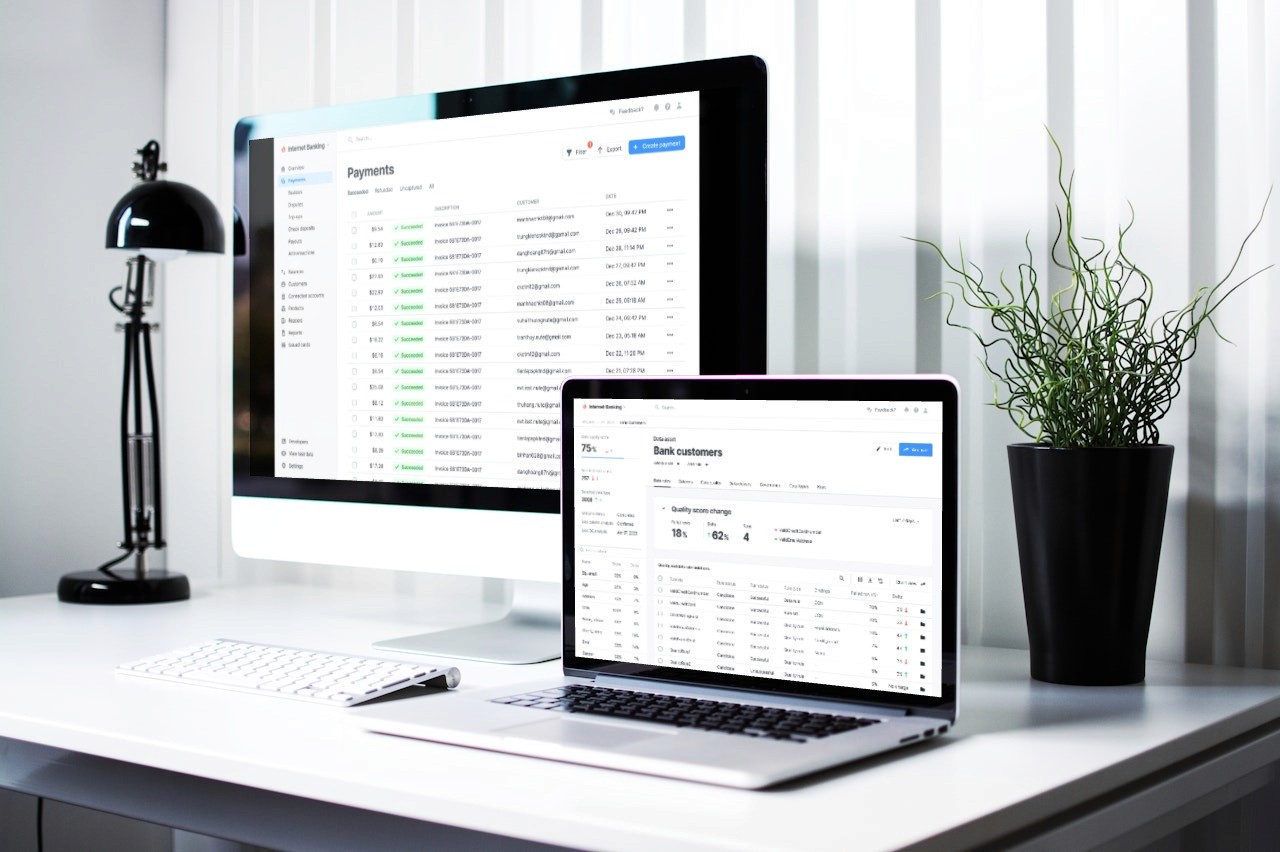

Utilizing a human-centered design approach, I led a project with a multidisciplinary team in reimagining the entire business process of marketing, financial, treasury teams, and the digital banking experience.

Our process began with in-depth user research to identify pain points and opportunities for improvement.

By implementing intuitive navigation and streamlining account management functionalities, we successfully increased user satisfaction by 25% and reduced task completion time by 30%, resulting in a significant boost in customer retention and engagement.

Utilizing a human-centered design approach, I led a project with a multidisciplinary team in reimagining the entire business process of marketing, financial, treasury teams, and the digital banking experience.

Our process began with in-depth user research to identify pain points and opportunities for improvement.

By implementing intuitive navigation and streamlining account management functionalities, we successfully increased user satisfaction by 25% and reduced task completion time by 30%, resulting in a significant boost in customer retention and engagement.

Utilizing a human-centered design approach, I led a project with a multidisciplinary team in reimagining the entire business process of marketing, financial, treasury teams, and the digital banking experience.

Our process began with in-depth user research to identify pain points and opportunities for improvement.

By implementing intuitive navigation and streamlining account management functionalities, we successfully increased user satisfaction by 25% and reduced task completion time by 30%, resulting in a significant boost in customer retention and engagement.

What were the problems?

What were the problems?

Fragmented Processes: The existing processes in marketing, financial, and treasury teams were disjointed, causing inefficiencies and communication breakdowns.

User Pain Points: Initial user research revealed significant pain points, including difficult navigation and cumbersome account management functionalities that frustrated users.

Stakeholder Alignment: Aligning the goals and expectations of various stakeholders across departments proved challenging, requiring extensive coordination and negotiation.

Technical Constraints: Integrating new solutions with legacy systems presented technical challenges, necessitating careful planning and execution to avoid disruptions.

Change Management: Ensuring that the staff adapted to new processes and tools required comprehensive training and support, as resistance to change was prevalent.

User Adoption: Encouraging users to embrace the new digital banking experience and trust the reimagined interface was critical but initially slow, requiring targeted communication and education strategies.

Fragmented Processes: The existing processes in marketing, financial, and treasury teams were disjointed, causing inefficiencies and communication breakdowns.

User Pain Points: Initial user research revealed significant pain points, including difficult navigation and cumbersome account management functionalities that frustrated users.

Stakeholder Alignment: Aligning the goals and expectations of various stakeholders across departments proved challenging, requiring extensive coordination and negotiation.

Technical Constraints: Integrating new solutions with legacy systems presented technical challenges, necessitating careful planning and execution to avoid disruptions.

Change Management: Ensuring that the staff adapted to new processes and tools required comprehensive training and support, as resistance to change was prevalent.

User Adoption: Encouraging users to embrace the new digital banking experience and trust the reimagined interface was critical but initially slow, requiring targeted communication and education strategies.

How did I resolve the problems?

How did I resolve the problems?

User Research: Conducted user interviews and observed banking customers' interactions with digital platforms. Held interviews with all cross functional team members of the different banking departments

Persona Development: Created detailed personas to represent different user segments and their needs.

Business Process Modelling: Mapped out all as-is business process diagrams (showing process gaps) for the different departments and the user processes. These as-is diagrams later informed the to-be business process diagrams mapped to resolve all gaps observed.

Design Sprints: Collaborated with cross-functional teams in week-long design sprints to ideate and prototype solutions.

Usability Testing: Conducted regular usability testing sessions to gather feedback and validate design decisions.

Agile UX: Implemented agile principles to iterate quickly on designs and respond to user feedback in real-time.

User Research: Conducted user interviews and observed banking customers' interactions with digital platforms. Held interviews with all cross functional team members of the different banking departments

Persona Development: Created detailed personas to represent different user segments and their needs.

Business Process Modelling: Mapped out all as-is business process diagrams (showing process gaps) for the different departments and the user processes. These as-is diagrams later informed the to-be business process diagrams mapped to resolve all gaps observed.

Design Sprints: Collaborated with cross-functional teams in week-long design sprints to ideate and prototype solutions.

Usability Testing: Conducted regular usability testing sessions to gather feedback and validate design decisions.

Agile UX: Implemented agile principles to iterate quickly on designs and respond to user feedback in real-time.

Project

Project

2019

2019