Streamlining an Insurance Claims Process

Streamlining an Insurance Claims Process

Streamlining an Insurance Claims Process

Project summary

Project summary

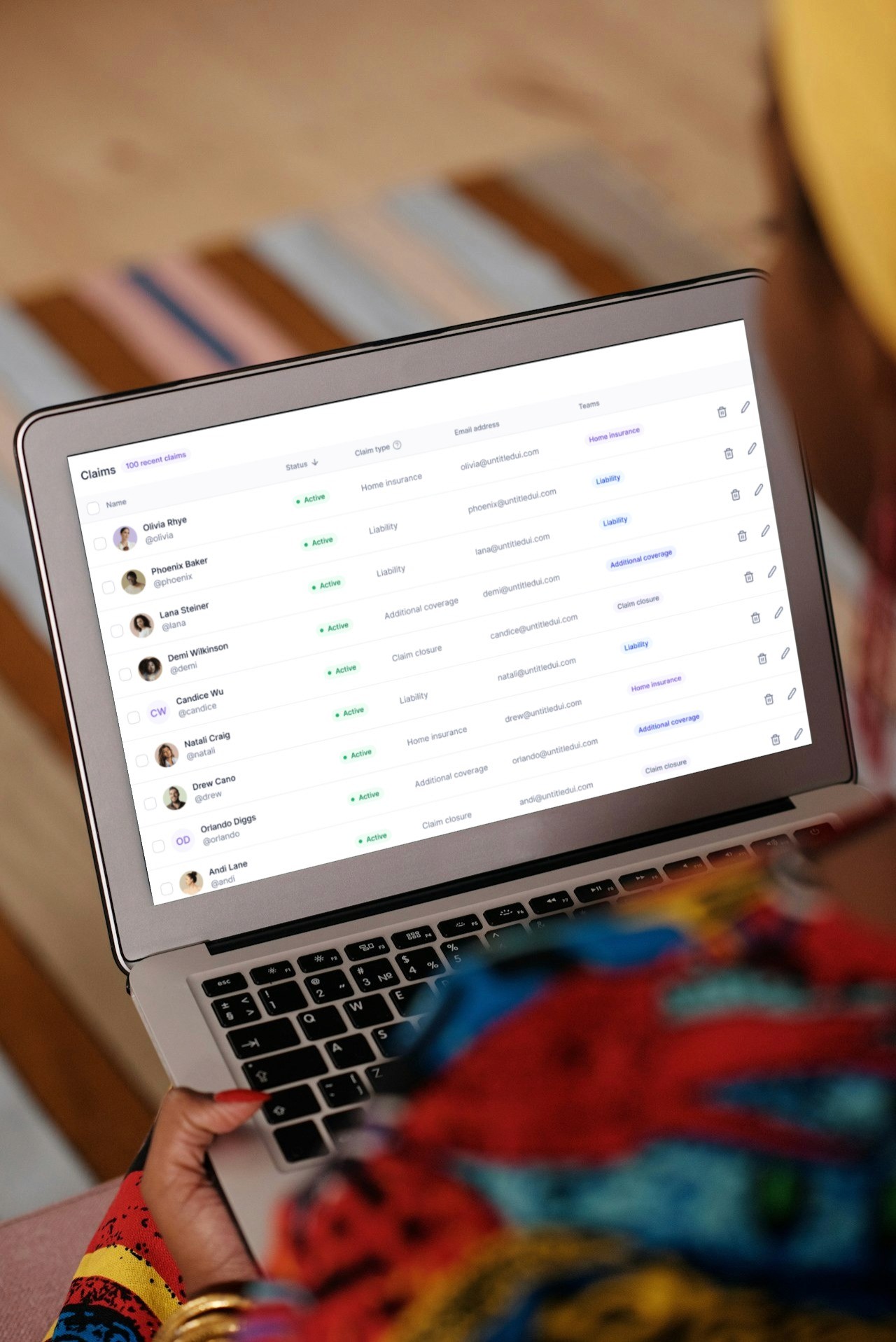

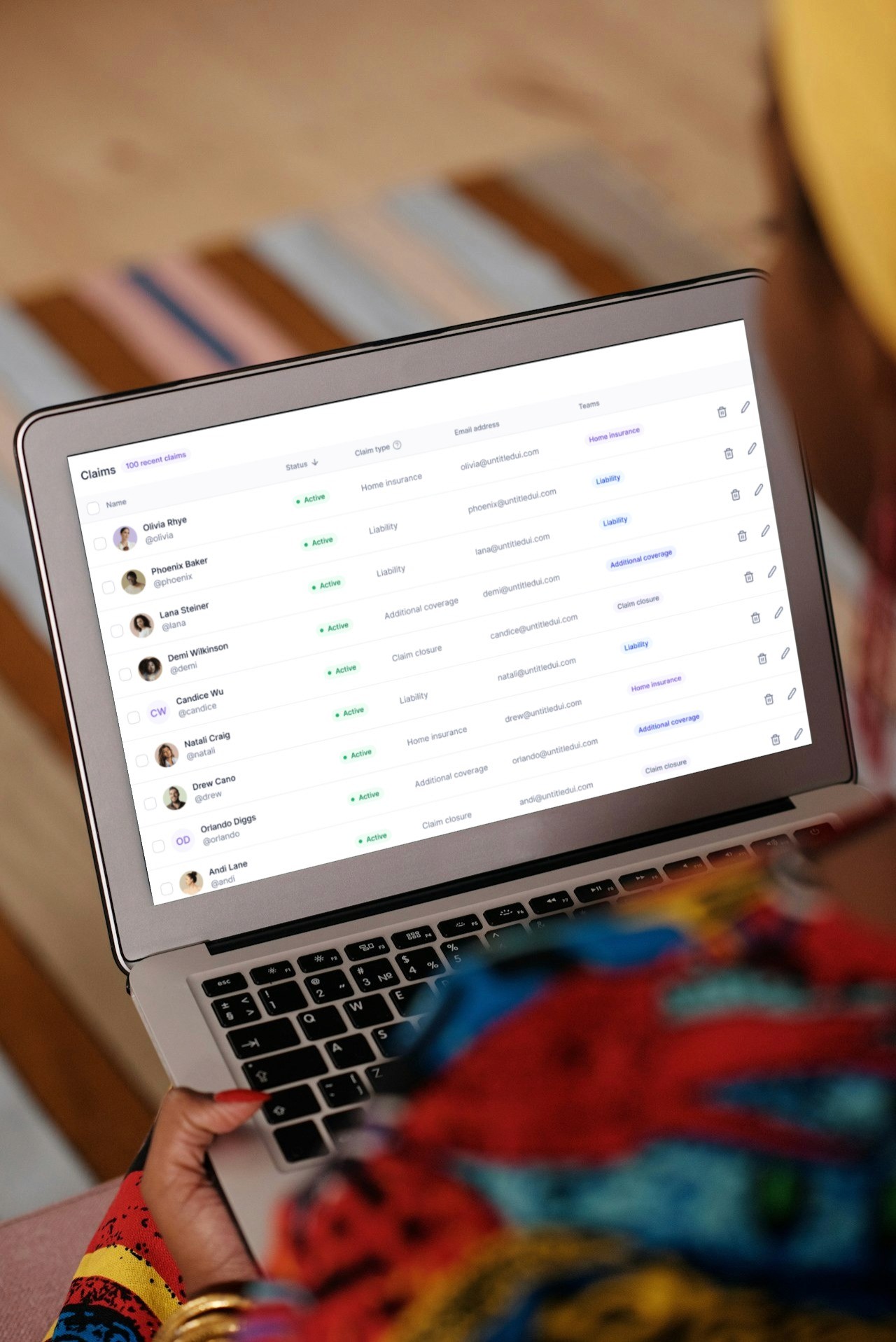

In collaboration with stakeholders, I spearheaded a UX initiative to streamline an insurance claims submission process.

Through empathetic user research and iterative prototyping, we identified bottlenecks and friction points, ultimately simplifying the process and enhancing usability.

As a result, we achieved a 40% reduction in submission time and received overwhelmingly positive feedback from users, leading to increased customer trust and loyalty.

In collaboration with stakeholders, I spearheaded a UX initiative to streamline an insurance claims submission process.

Through empathetic user research and iterative prototyping, we identified bottlenecks and friction points, ultimately simplifying the process and enhancing usability.

As a result, we achieved a 40% reduction in submission time and received overwhelmingly positive feedback from users, leading to increased customer trust and loyalty.

In collaboration with stakeholders, I spearheaded a UX initiative to streamline an insurance claims submission process.

Through empathetic user research and iterative prototyping, we identified bottlenecks and friction points, ultimately simplifying the process and enhancing usability.

As a result, we achieved a 40% reduction in submission time and received overwhelmingly positive feedback from users, leading to increased customer trust and loyalty.

What were the challenges?

What were the challenges?

Cumbersome Manual Processes: Existing paper-based and manual claims processing workflows led to inefficiencies and delays.

Lack of Transparency: Limited communication channels resulted in a lack of transparency and delays in claim status updates for policyholders.

Data Fragmentation: Disparate systems and manual data entry resulted in fragmented data and inhibited data-driven decision-making.

Cumbersome Manual Processes: Existing paper-based and manual claims processing workflows led to inefficiencies and delays.

Lack of Transparency: Limited communication channels resulted in a lack of transparency and delays in claim status updates for policyholders.

Data Fragmentation: Disparate systems and manual data entry resulted in fragmented data and inhibited data-driven decision-making.

How did I handle the challenges?

How did I handle the challenges?

User Research: Conducted in-depth interviews and surveys with insurance claimants to understand pain points and challenges.

Design Thinking: Applied empathy mapping and journey mapping to visualize the user experience and identify opportunities for improvement.

Iterative Prototyping: Developed low-fidelity wireframes and high-fidelity prototypes to test and refine the claims submission process.

Agile UX: Implemented agile methodologies, including sprint planning, daily stand-ups, and iterative design reviews.

Collaboration: Worked closely with stakeholders, including insurance agents and IT teams, to ensure alignment with business goals.

User Research: Conducted in-depth interviews and surveys with insurance claimants to understand pain points and challenges.

Design Thinking: Applied empathy mapping and journey mapping to visualize the user experience and identify opportunities for improvement.

Iterative Prototyping: Developed low-fidelity wireframes and high-fidelity prototypes to test and refine the claims submission process.

Agile UX: Implemented agile methodologies, including sprint planning, daily stand-ups, and iterative design reviews.

Collaboration: Worked closely with stakeholders, including insurance agents and IT teams, to ensure alignment with business goals.

Project

Project

2015

2015

Design and User experience Recommendations

Design and User experience Recommendations

Digital Claims Submission: To enhance the user experience, my team and I designed features that would potentially promote seamless claims submission, and reduce paperwork.

Automated Claims Processing: We also recommended implementation of artificial intelligence and machine learning algorithms to automate claims processing, reducing manual intervention and accelerating claim approval.

Real-Time Communication: Worked hand-in-hand with customer experience teams to establish a system for real-time communication between insurers, adjusters, and policyholders to provide updates on claim status and requirements promptly.

Data Analytics: Recommended utilization data analytics to identify patterns and trends in claims processing, enabling proactive risk management and fraud detection.

Digital Claims Submission: To enhance the user experience, my team and I designed features that would potentially promote seamless claims submission, and reduce paperwork.

Automated Claims Processing: We also recommended implementation of artificial intelligence and machine learning algorithms to automate claims processing, reducing manual intervention and accelerating claim approval.

Real-Time Communication: Worked hand-in-hand with customer experience teams to establish a system for real-time communication between insurers, adjusters, and policyholders to provide updates on claim status and requirements promptly.

Data Analytics: Recommended utilization data analytics to identify patterns and trends in claims processing, enabling proactive risk management and fraud detection.

Results

Results

Improved Efficiency: Streamlined workflows and automation reduced claims processing time by 35%, improving operational efficiency.

Enhanced User Experience: Digital platforms and real-time communication channels led to increased satisfaction among policyholders, with 70% reporting a positive experience.

Data-Driven Insights: Data analytics provided actionable insights, enabling proactive risk management and fraud detection, leading to 40% reduction in fraudulent claims.

Improved Efficiency: Streamlined workflows and automation reduced claims processing time by 35%, improving operational efficiency.

Enhanced User Experience: Digital platforms and real-time communication channels led to increased satisfaction among policyholders, with 70% reporting a positive experience.

Data-Driven Insights: Data analytics provided actionable insights, enabling proactive risk management and fraud detection, leading to 40% reduction in fraudulent claims.

Outcomes

Outcomes

The application achieved reduction in submission time through process simplification.

Enhanced usability and user satisfaction, leading to increased customer trust and loyalty.

Streamlined communication and collaboration between stakeholders, fostering a culture of innovation.

The application achieved reduction in submission time through process simplification.

Enhanced usability and user satisfaction, leading to increased customer trust and loyalty.